In today’s challenging insurance landscape, it’s no secret that premiums are on the rise. This industry-wide issue is affecting many consumers, and we here at Smart Insurance understand the importance of equipping our clients with the necessary resources to navigate this market effectively.

Why home and auto insurance rates are continuing to rise in 2024

Thanks to an unusual convergence of market trends, ushered in by the pandemic and followed by other disruptive events, you may see a bigger change to the cost of your home and auto insurance than usual when it comes time to renew your policies this year.

Insurance rates are based on what an insurer thinks it will cost to make you whole in the event of a loss – whether it’s roof damage during a windstorm or a vehicle totaled during a traffic accident. As you’ve likely noticed, pretty much everything costs more than it did even a few years ago.

And just in case you think we’re immune from the increase…we’re not. Our agents are experiencing unprecedented premium increases, with no claims, no tickets, no accidents–so we truly are all in this together.

What’s driving higher home insurance costs

If you’ve shopped at Home Depot, Lowe’s, or even Wal-Mart lately, you’ve certainly seen that the price tags on building materials have gotten pretty expensive. Last year, the cost of building materials rose 4.7%, reflecting a particularly strong uptick in prices on things like asphalt shingles (16.2%), concrete blocks (18.5%) and drywall (20.4%).

To make matters worse, the home-building industry is facing a shortfall of more than 300,000 skilled laborers, which is driving up construction-related labor costs. Combined with the high cost of construction materials and historically low housing inventory, this has been making home claims much more expensive for insurance companies.

Infographic courtesy of Safeco Insurance

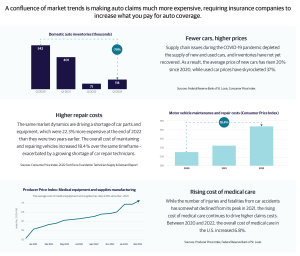

What’s driving higher auto insurance costs

Ongoing supply chain issues are driving a shortage of car parts and equipment, which were 22.3% more expensive at the end of 2022 than they were two years earlier. The overall cost of maintaining and repairing vehicles increased 18.4 % over the same timeframe – exacerbated by a growing shortage of car repair technicians.

The same issues depleted the supply of new and used cars during the COVID-19 pandemic, and inventories have not yet recovered. As a result, the average price of new cars has risen 20% since 2020, while used car prices have skyrocketed 37%.

Rising medical costs are another key factor. While the number of injuries and fatalities from car accidents has somewhat declined from its peak in 2021, the rising cost of medical care continues to drive higher claims costs. Between 2020 and 2022, the overall cost of medical care in the U.S. increased 6.8%.

Finally, litigation expenses are rising, and they’re rising FAST. In 2022, it’s estimated that litigation costs rose 30% in that year alone. As we’ve already said, EVERYTHING is more expensive right now.

Infographic courtesy of Safeco Insurance

Customer FAQ’s for a HARD Market

Why is my insurance bill so high?

Insurance companies are raising rates to keep pace with rising costs, so they can continue to pay out claims. They pay to repair and rebuild houses, fix cars, and cover hospital bills for people who’ve been hurt in accidents. These costs have skyrocketed for a bunch of reasons. Some of them you’re probably familiar with, like higher labor and materials costs and supply-chain issues.

But I didn’t have a claim — why am I affected?

Claims history is just one factor in your rates — this increase reflects industry-wide trends that are affecting all policyholders right now. Like any business, insurance companies must raise rates when their costs rise. Right now they’re dealing with inflation plus unexpected costs from more frequent and severe catastrophic weather events, increasing medical costs and legal system abuse.

Can you get me a better rate?

My job is to help you find the protection you need at a competitive rate. Right now insurance companies across the board are raising rates and being pickier about what they’ll cover. Let’s review your account to see if switching carriers makes sense — or if adjusting deductibles, coverages or discounts could give you a better overall value.

Have more questions? Check out this short video that Our partners at Safeco put together to help explain the hard market

Focus on value as you explore ways to save

You’re probably thinking…wow, this all sounds really terrible for my cost of insurance. And you’re not wrong; however, keep in mind that savings come in many forms. The value of the coverage you choose today may save you more in the long run than the lowest possible premium.

Contact us to review your current coverage, you’ve got the entire team at Smart Insurance willing to work for you & to research the best options for cost savings but also for adequate coverage. We’ll also help you explore opportunities for discounts that could offset higher rates when it comes time to renew.

From all of us at Smart Insurance, we want to ensure that you are well-informed and prepared to make the best decisions for your insurance needs. If you have any questions or require further assistance, don’t hesitate to give us a call, text, or email. Our team is here to provide you with the tools and expertise needed to thrive in this environment.

Sources: National Association of Realtors, Federal Reserve Bank of St. Louis, Home Builders Institute, CoreLogic, Consumer Price Index, TechForce Foundation, Safeco Insurance Company